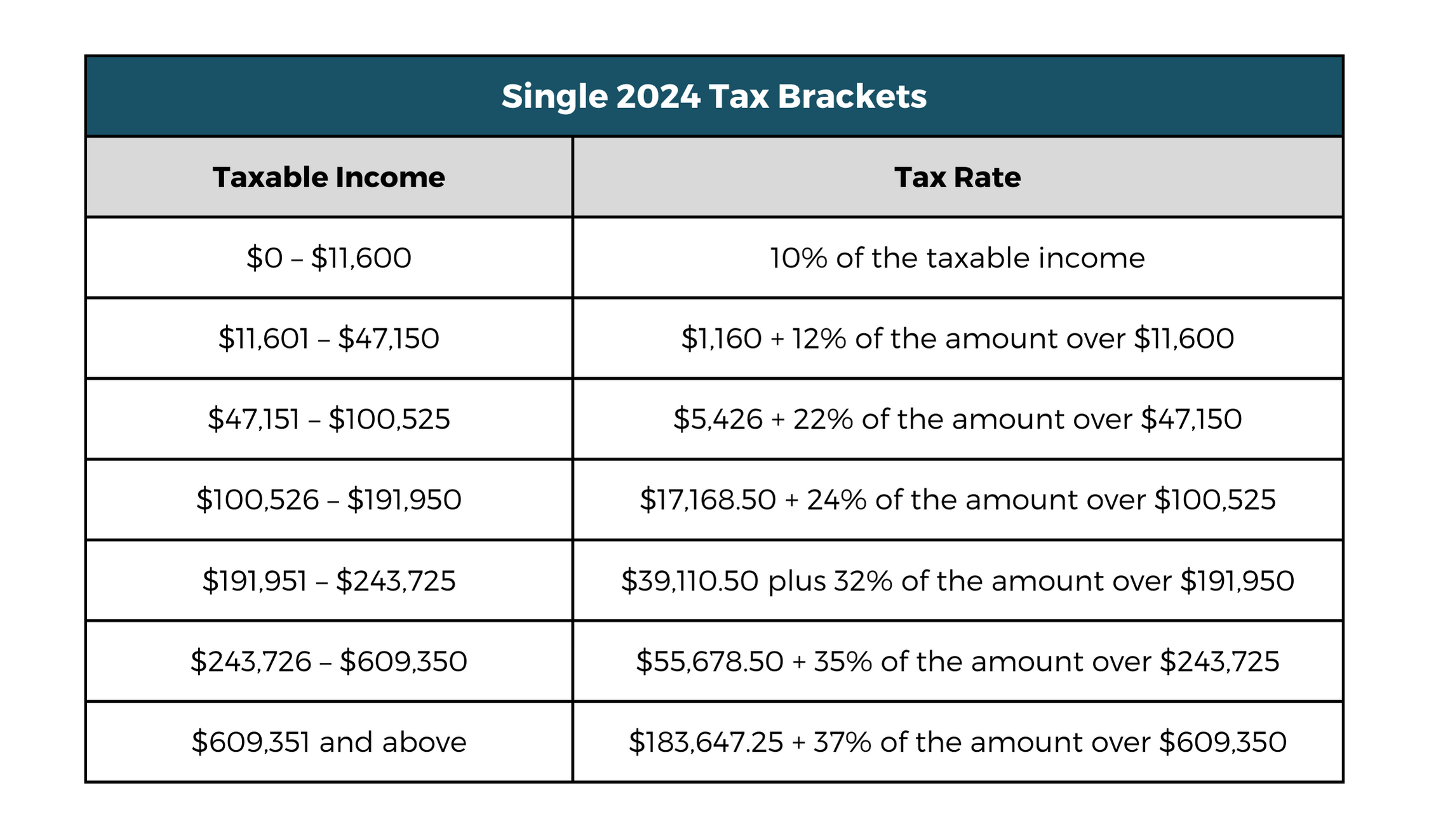

2025 Tax Deduction Tables - T200018 Baseline Distribution of and Federal Taxes, All Tax, You pay tax as a percentage of your income in layers called tax brackets. An individual has to choose between new and. If you make $70,000 a year living in new mexico you will be taxed $10,176.

T200018 Baseline Distribution of and Federal Taxes, All Tax, You pay tax as a percentage of your income in layers called tax brackets. An individual has to choose between new and.

CASE STUDY INFORMATION Helga Hemp owns Born Again, An individual has to choose between new and. This article summarizes income tax rates, surcharge, health & education cess, special rates, and rebate/relief applicable to various categories of persons viz.

T200054 Share of Federal Taxes All Tax Units, By Expanded Cash, Refer examples & tax slabs for easy calculation. There has been no official announcement regarding an increase in the section 80c deduction limit for budget 2025.

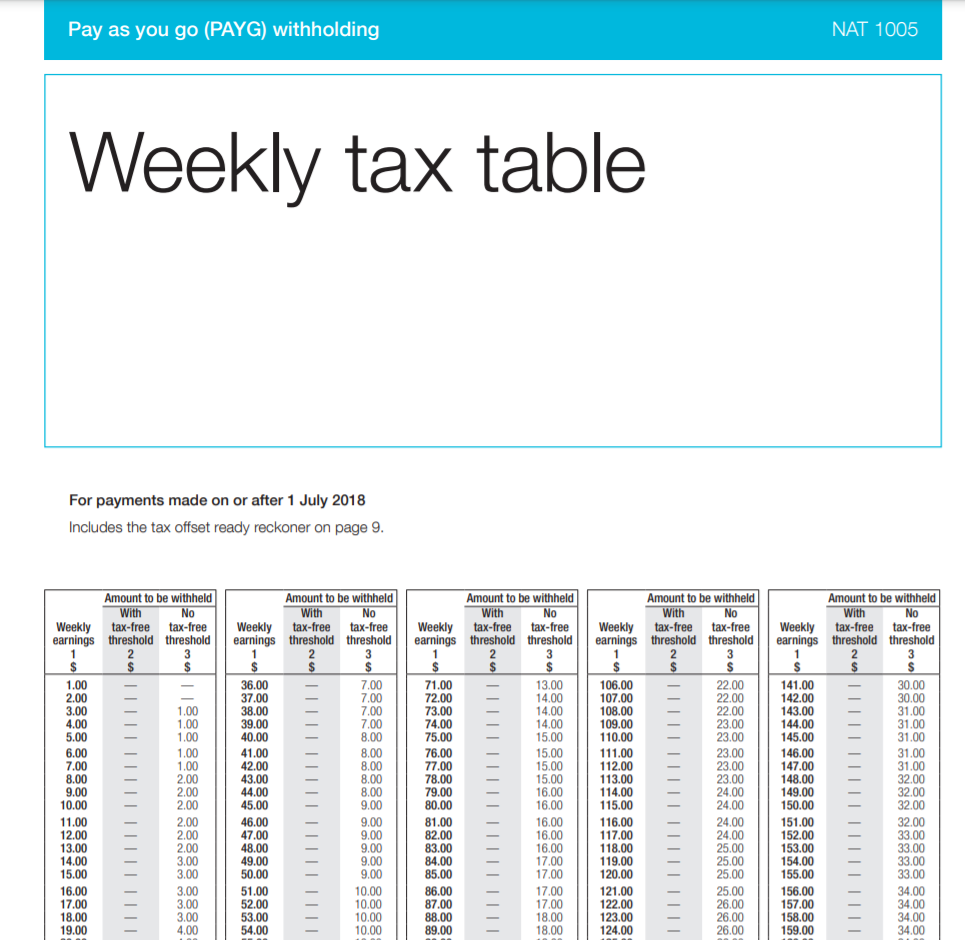

T200055 Share of Federal Taxes All Tax Units, By Expanded Cash, If you make $70,000 a year living in new mexico you will be taxed $10,176. The required tax changes for the 2025/24 financial year have been implemented in reckon payroll.

Tax Rates 2025 2025 Image to u, If you make $70,000 a year living in new mexico you will be taxed $10,176. You pay tax as a percentage of your income in layers called tax brackets.

2025 Tax Deduction Tables. A resident individual (whose net income does not exceed rs. If you make $70,000 a year living in new mexico you will be taxed $10,176.

T220098 Share of Federal Taxes All Tax Units, By Expanded Cash, Tax year 2025 tax rates and brackets. Individual income tax rates will revert to.

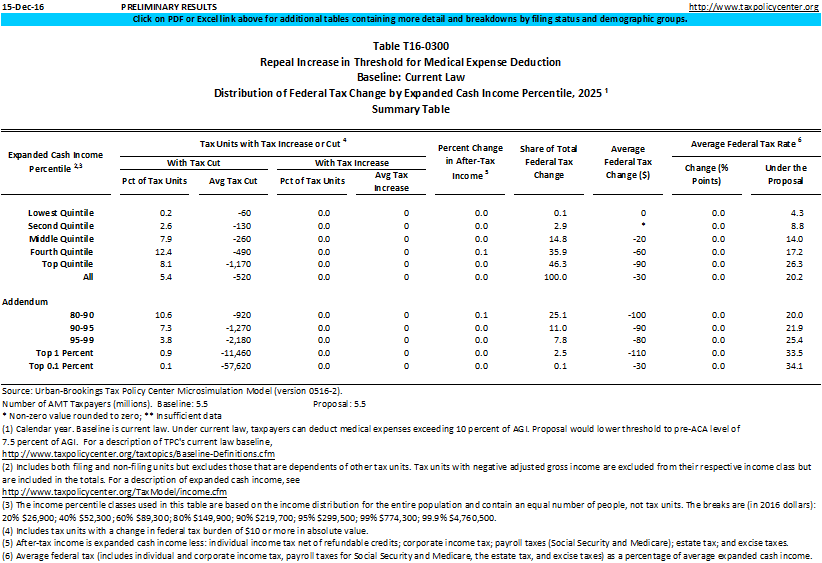

T160300 Repeal Increase in Threshold for Medical Expense Deduction, The above calculator is only to enable public to have a quick and an easy access to basic tax calculation and does not purport to give correct tax calculation in all. Individual income tax rates will revert to.

All of the individual tax provisions of the 2025 tax cuts and jobs act (tcja) expire at the end of 2025. R251,258 + 41% of taxable income above r857,900.

T220251 Distribution of Federal Payroll and Taxes by Expanded, All of the individual tax provisions of the 2025 tax cuts and jobs act (tcja) expire at the end of 2025. Several sections of the income tax act specify tds rates , payment.

T220251 Distribution of Federal Payroll and Taxes by Expanded, Deduction under section 16(ia) of rs. A resident individual (whose net income does not exceed rs.